SIGN UP FOR YOUR

CREDIT REPORT

Q. How long does it take to repair my credit?

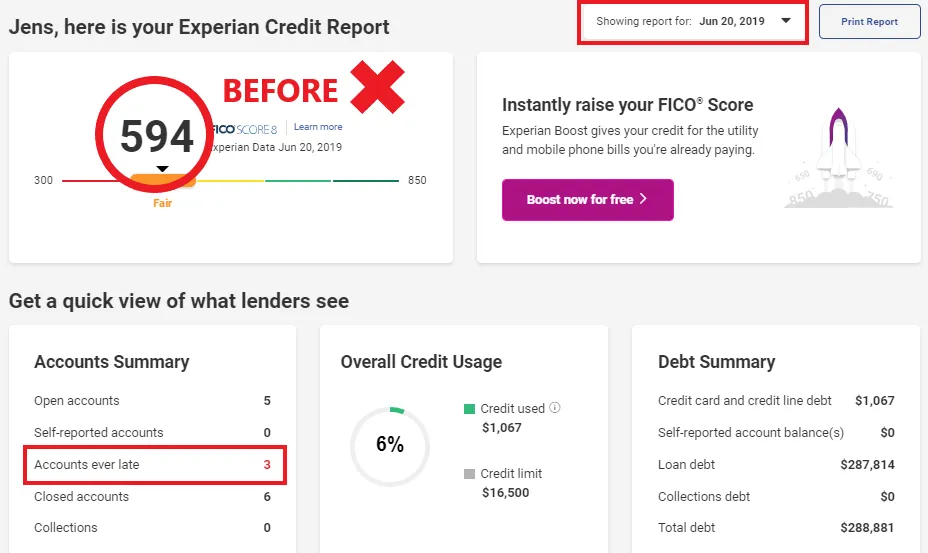

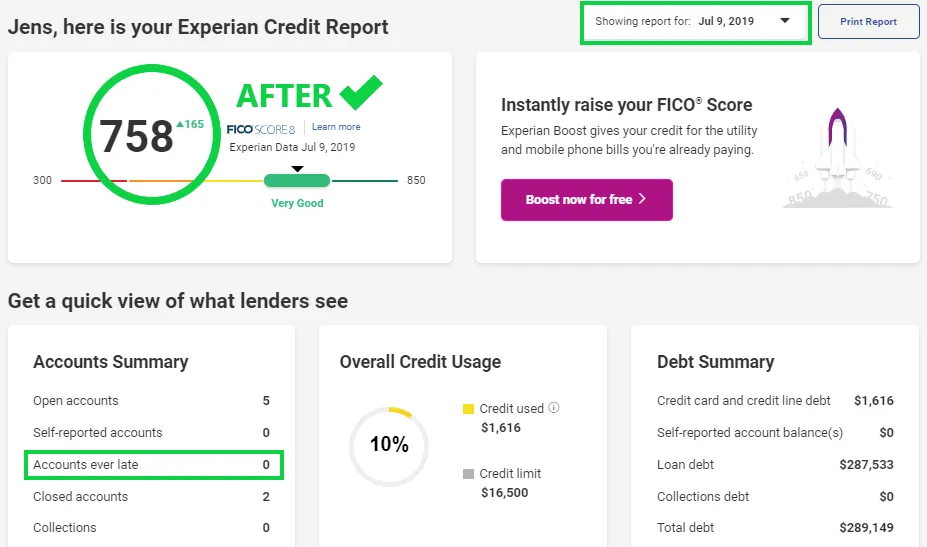

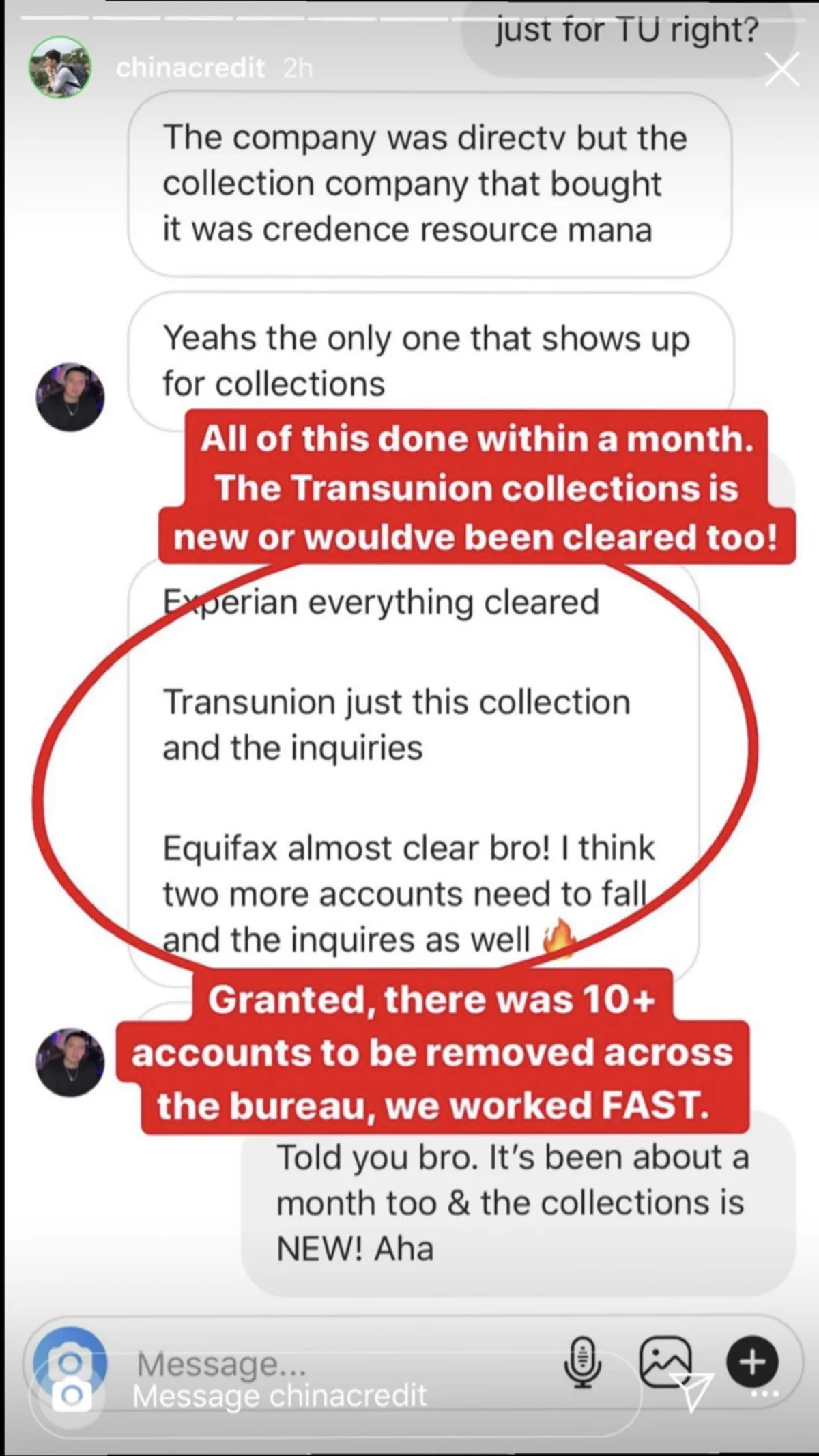

A. Our credit rebuilding program at OPM Mastery runs for 6 months. However, we have a proven track record of getting peak results within the first 3-4 months. Results vary due to a multitude of factors.

Q. How do I get updates on my credit report ?

A. You will receive monthly updates via email from our Credit Rebuilding Team on a 30 day basis as soon as your new credit reports are made available to us. In order for our team to keep our progress on-time, it is important for you to maintain an active credit monitoring service with our partners Credit Hero Score.

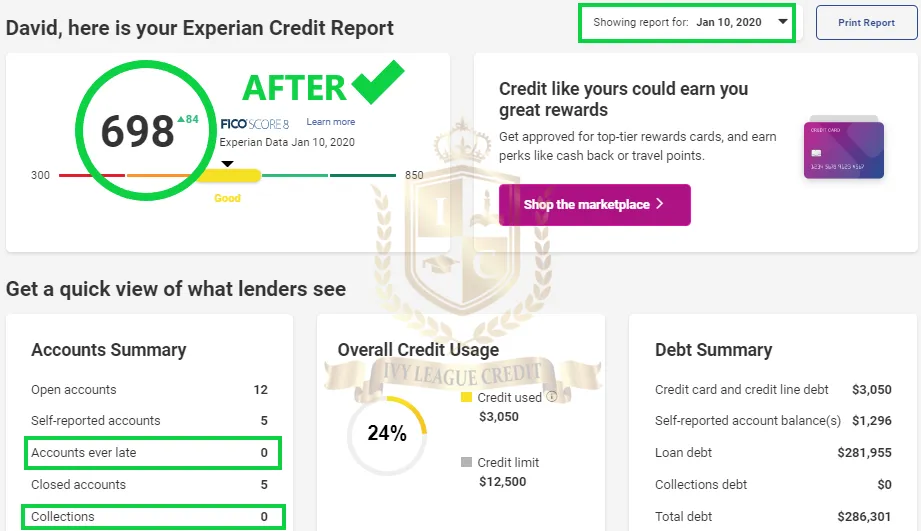

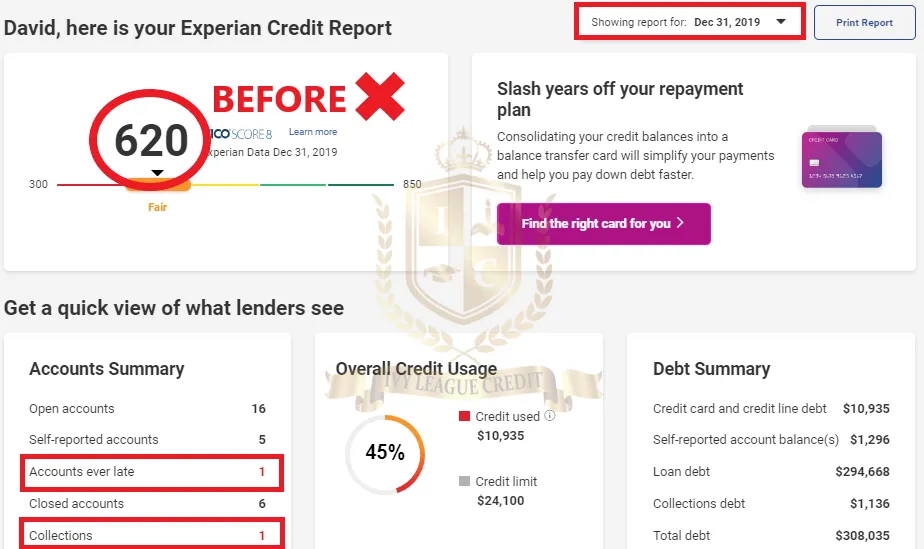

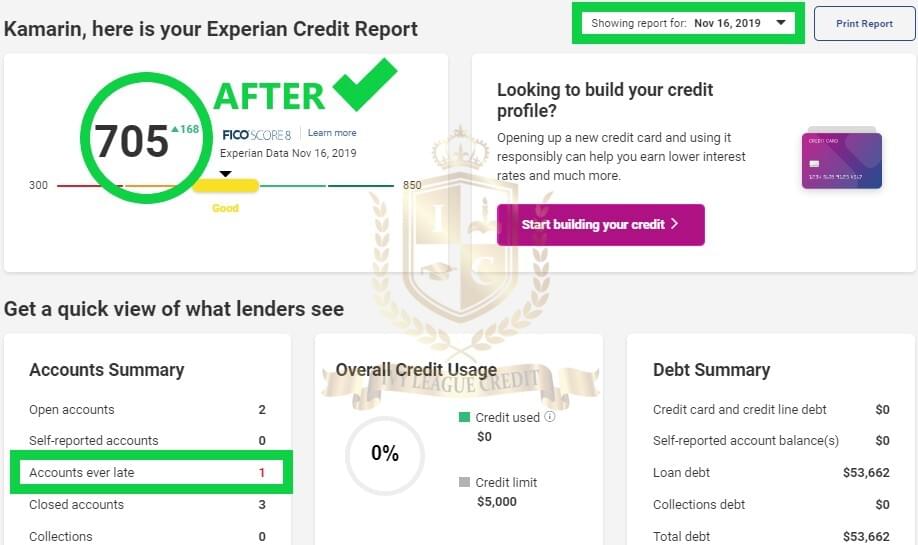

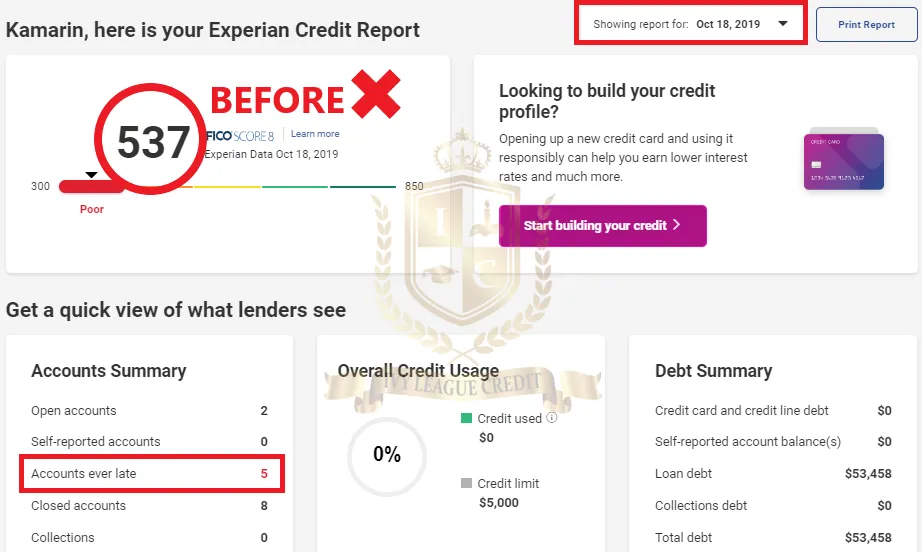

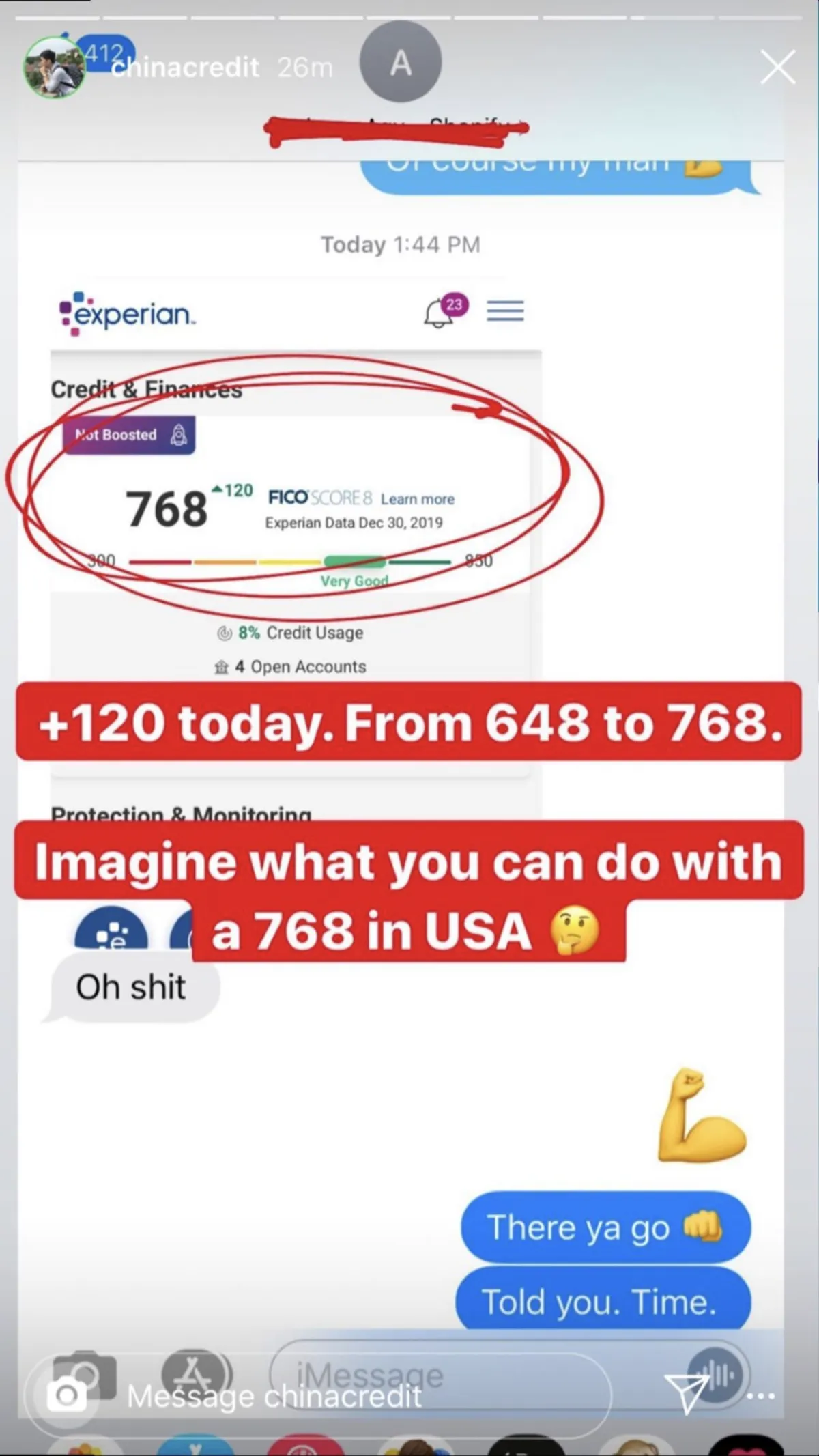

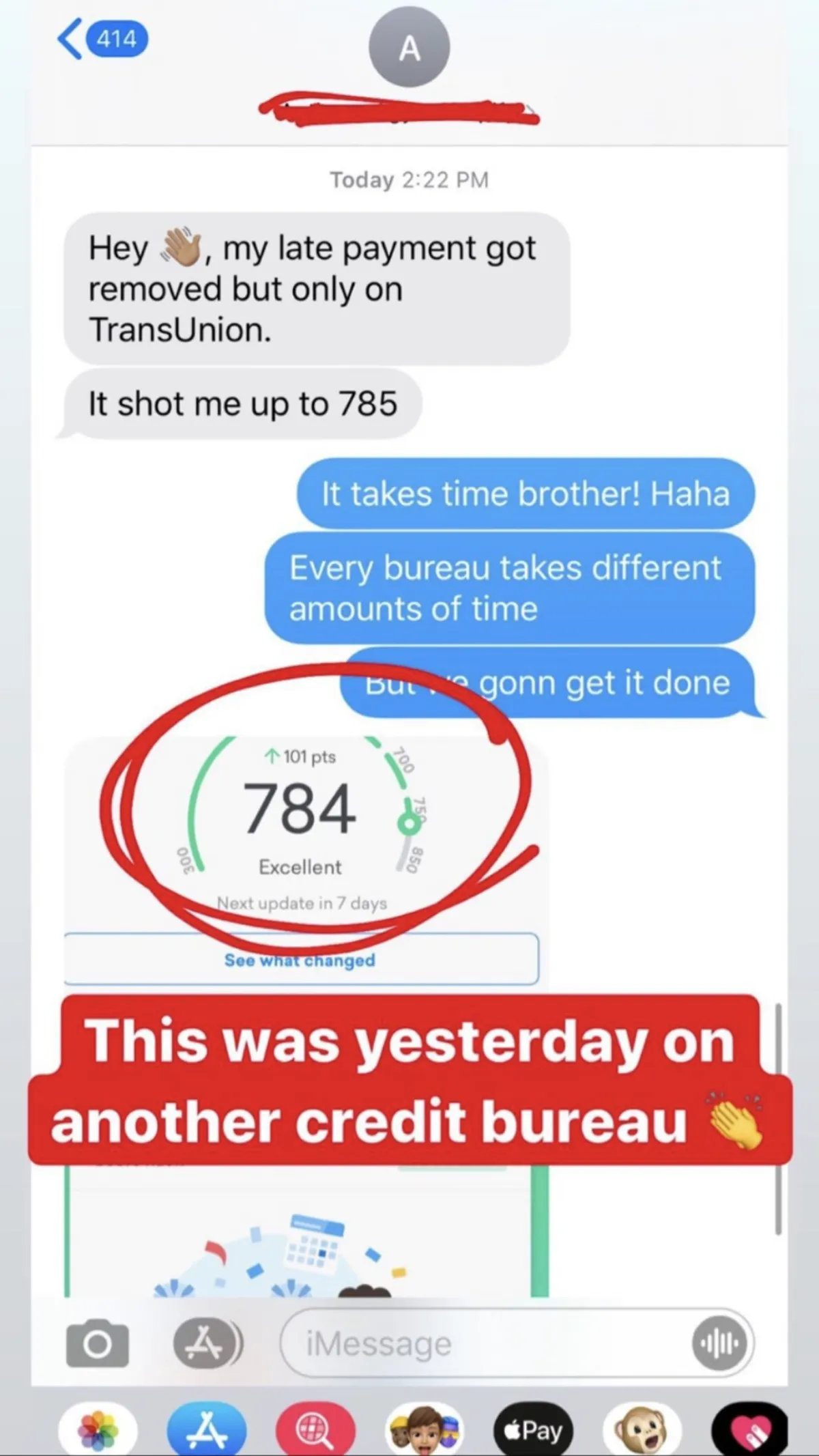

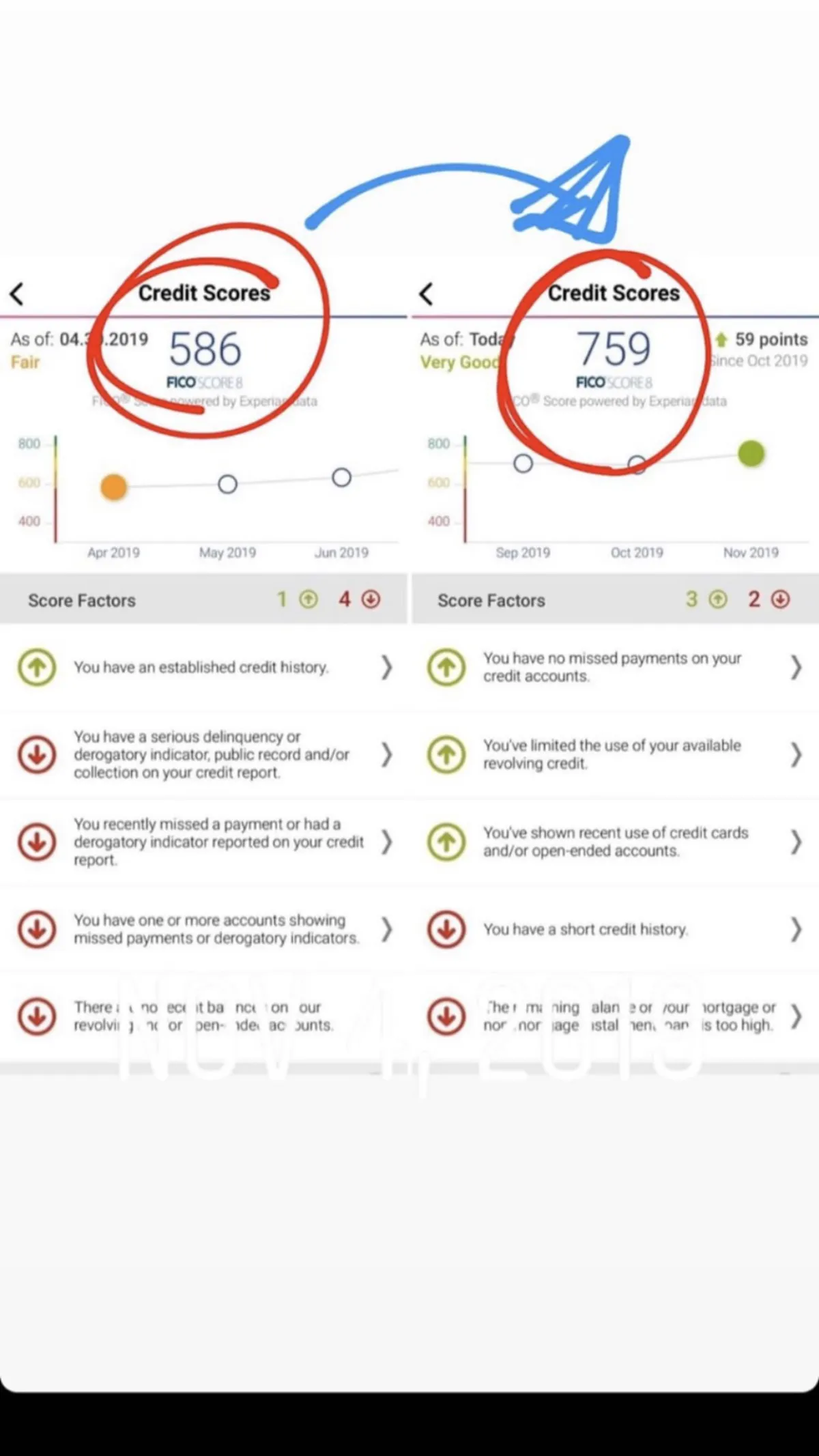

Q. How much can my score rise by?

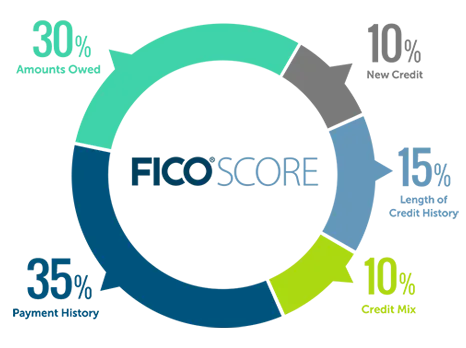

A. This is really dependent on what remaining accounts you have on your credit score. At the end of your credit repair, if we remove all negative accounts but your remaining utilization is super high or average age is super low, your credit score still will not be at maximum potential.

It's important to keep this in mind: We are in the business of disputing/removing negative & inaccurate information off your credit reports, we are NOT in the business of increasing your credit score.

Your credit score may increase as a result of negative information dropping from your result but it could also remain the same depending on you manage other factors of your credit.

Q. If I pay a collection, does it automatically get removed from my credit report ?

A. No, one of the biggest misconceptions among customers is that paying a collection will cause the score to go up. This is not true. In fact, your score is likely to go down. That’s why we highly recommend NOT to pay any collection while undergoing our credit repair services as it is NOT NECESSARY and WON’T increase your credit score in any means.

Q. Why is there the need of repairing credit?

A. In the United States, credit worthiness affects all major aspects of your financial life. Whether you want to mortgage a house, get a loan on a car, or even simple things such as apply for credit cards, a higher credit score lowers the interest rates as well as improves your acceptance chance from creditors. Fun fact : The total amount paid between 600 and 740 when it comes to obtaining a mortgage loan could differentiate hundreds of thousands of dollars in interest paid.

Because your credit record will influence your qualification for credit in the future, and could possibly affect rates for your current credit lines. Accordingly, if your credit report is incorrect, the reparation of the credit file will help improve your chances. A good credit score helps you obtain low interest rates and long term loans, like home loans or car loans. Lenders may charge high interest rates or impose undesirable repayment plans for you. Given the stakes and the consequences involved, it is clearly to your advantage to work toward recovering from a bad credit rating.

Q. Do I need to keep my CreditHeroScore membership active during the credit disputing process ?

Yes this is necessary, as our dispute software is compatible with CreditHeroScore. This will ensure that all your information on your credit report is correctly stated so we know what or not to dispute if we do need to send in a second round of letters.

Q. Why did my score drop after the negative items are removed off my credit report ?

A: When negative information is deleted from your credit report, you probably won’t see an increase immediately. However, you almost certainly will see an improvement fairly quickly if deleting the negative information is the only change. There are two things that influence credit scores when information is deleted from your credit history.

The obvious one is that negative information is removed. That is the positive. The less obvious issue is stability. Credit scores not only weigh the information in your credit report at a certain moment, they also consider your credit behavior over time.

A stable account history showing consistent, positive behavior is important to credit scores. By deleting negative information, a degree of instability has been introduced that the credit scoring system cannot immediately account for as a positive change.

Initially, the deleted information and the instability cancel each other out, resulting in little or no change in your credit score.

Sometimes there may even be a slight decrease in the score. But, after the next payment period or two, your credit history will appear stable again, and deletion of the negative information should result in a positive change to the credit score.

Q. On my credit report it states that a negative item will be removed on a specific date…will the credit reporting agency automatically remove it on that date ?

A: Most of the time they will but sometimes they don't and it will negatively affect your credit score. We've seen items such as: bankruptcies, liens, collections and repossessions that should have been removed on a specific date and the credit reporting agencies neglected to have them removed.

COPYRIGHT 2022 | OPM Mastery, Inc | ALL RIGHTS RESERVED